Platform’s proposals to boost zero-emission vehicles in corporate and urban fleets

Platform’s proposals to boost zero-emission vehicles in corporate and urban fleets

With the European Union agreement on -55% greenhouse gas emissions (GHG) by 2030, all economic sectors will have to pull their weight towards this goal. Unfortunately, the transport sector has a poor decarbonization track-record with emissions steadily growing since 1990.

Looking at all transport modes, road transport is still the largest emitter (71%) and will remain so in the near future[1]. Recently adopted CO2 emission performance standards, investment in charging infrastructure, etc. will eventually drive down emissions, but new initiatives aimed at “quick wins” are needed to fast-track decarbonization.

These initiatives should be based on the idea that when fighting against climate change and local pollution, not all vehicles are equal. Fleet vehicles (i.e. corporate fleets) drive on average 2.25 times[2] more than private cars. Public fleets, such as urban buses which account for 8%[3] (per passenger per km) of greenhouse gases (GHG) emitted by the transport sector, are also big players. Last but not least, as fleet vehicles are often parked in depots and large parking lots, their batteries could be used to optimise the RES integration and the use of smart charging could provide benefits to local utilities and to the whole power system[4].

Against that background, the Platform for electromobility welcomes the European Commission’s ambition to electrify public and corporate fleets recently introduced in the Smart and Sustainable Mobility Strategy.

In this paper, we share our insight and expertise to make this a reality. We first recommend ensuring an ambitious implementation of the Clean Vehicle Directive (CVD) for public fleets in all Member States (MS). Second, new legislation dedicated to the electrification of corporate fleets should be envisaged.

Implementing the Clean Vehicle Directive

While at its adoption in 2019, we expressed our enthusiasm that the CVD would pave the way for a broad deployment of clean vehicles across Europe – electric buses in particular – it seems likely that few MS will transpose the directive in time.

As of April 2021, only France has implemented the directive, and only a few more MS have started the transposition process which is due to be completed by 2nd August 2021. There is a risk that an unequal transposition of the directive will lead to fragmentated and non-harmonized access to clean transportation and its benefits for citizens between MS.

Recent bus registration figures also show that while the sales of electric buses are progressing, most countries are still nowhere near the CVD targets [6]. Therefore, we call the legislators to push for a better and faster implementation of the CVD in most MS. National governments should make the best use of available funds, including national and European recovery plans, to achieve the targets of the directive.

Electrification of public fleets covered by the CVD is only one step on the road to a 90% cut in transport emissions by 2050. Electrifying corporate fleets[7] constitute another powerful leverage towards the decarbonation of transportation in Europe.

Leveraging corporate fleets to curb emissions

Corporate cars represent millions of high-mileage vehicles circulating in Europe with a high turnover. They now also represent the main part of the car market in Western Europe. According to a recent Deloitte[8] report, in 2010 the private and corporate market segments were almost equally large in Western Europe (respectively 7.3 million vs. 7.2 million car registrations). In 2016, the balance had already tilted in favour of corporate cars (58%), and by 2021, Deloitte forecasts a share of new car registrations of 37% for the private and 63% for the corporate channel. In countries not covered by the study like Poland, corporate cars share in a new passenger car market is even larger, reaching 75% in 2020[9].

Corporate cars quickly become private cars via the second-hand market after an average ownership of 36 to 48 months. Most Europeans indeed purchase private cars after they used corporate functions[10]. The electrification of corporate fleets is therefore key to also electrify the whole stock (owned by individuals) with a reasonable time gap.

Corporate fleets represent 20% of the total vehicle park in Europe, 40% of total driven kilometers but is responsible for half of total emissions from road transport. Starting with corporate fleets is the quickest way to reach emission cuts.[11]

Additionally, corporate cars are highly visible in our cities. By leading by example and supplying the second-hand market, electrified corporate vehicles will increase acceptability and accessibility of electric cars for European households. The electrification of this market therefore is not only a ‘low hanging fruit’, it has significant indirect impacts on other markets. As such, it is a major element for the electric vehicles (EVs) market to reach a critical mass.

Additionally, corporate cars are highly visible in our cities. By leading by example and supplying the second-hand market, electrified corporate vehicles will increase acceptability and accessibility of electric cars for European households. The electrification of this market therefore is not only a ‘low hanging fruit’, it has significant indirect impacts on other markets. As such, it is a major element for the electric vehicles (EVs) market to reach a critical mass.

Yet, the electrification potential of corporate vehicles remains largely untapped, due to a lack of clear rules and incentives. Indeed, along with main files such the Eurovignette Directive currently under negotiation, and which would be an important incentive for greening fleets, a whole patchwork of initiatives is included in existing and upcoming legislations. We remind that a successful electrification of corporate fleet shall be linked with a strong roll-out of public and private of charging infrastructures. Annex 1 below outlines our positions on these legislative files and why they will suffice to yield the way to a full decarbonisation of corporate fleets.

With no legislative instrument at hand today, the European policy lacks teeth when it comes to electrification of corporate fleets. We invite policy makers to require more and more fleets such as company cars, taxis, leasing and renting companies and delivery vehicles to electrify, and support companies towards this goal.

To do so, we call for the establishment of a new single regulation dedicated to the electrification of corporate fleets.

Call for a new proposal on the electrification of corporate fleets

A new legislation on the electrification of corporate fleets would set a clear path and objective. This new legislation should include the following provisions:

For a start, such a legislation should equally apply across the European internal market. Therefore, we believe a regulation would be the most suitable legislative instrument to accelerate fleet electrification. The regulation would harmonize the European market by preventing risks of increased gaps between MS during the implementation. This is particularly important for internal market cohesion and regulatory clarity for businesses owning fleet across the EU. A regulation would have the final benefit of having a direct effect.

A realistic yet ambitious mandate should be put on companies to decarbonise their vehicle fleets in accordance with the European Green Deal’s objectives. Fleet electrification is a journey that requires following a roadmap and trials before scaling up in largest companies. Considering the timing of application of the regulation and the ability of companies that recently purchased vehicles or have larger fleets to react a stepwise approach is with interim targets therefore required.

| We recommend setting a gradual approach to progressively but eventually reach the objective of 100% of new vehicle purchase in corporate fleets to be electrified by 2030. |

To avoid imposing a heavy burden on the smallest companies, the regulation should apply to fleets above a certain size. Thresholds should be based on a robust methodology to consider the different segments, industries and MS characteristics while keeping in mind the lower the threshold, the higher the incentives should be for smaller fleets. Next to the electrification of the corporate fleets, companies should consider multimodal packages where a Zero-emission vehicle is combined with other sustainable transport solutions.

The Regulation’s provisions should differentiate between fleets in their capacity to make the change based on their usual turnover and nature of the transport they perform. Some fleets should face stricter and faster pace to electrification while other could be given more time to electrify. For example, new taxis and private hire vehicles (PHV) committed to drive fully electric vehicles should be issued licences in priority over ICE drivers while fleets in specific industries with technological obstacles (e.g. logging/lumbering industry) may be given derogations.

Along with mandatory targets and compliance mechanisms, incentives for fleet owners will also be needed at European and national levels to accompany the shift. Inspiration for positive incentives should be drawn from lessons learnt from well-designed benefit in kind systems for corporate cars across MS. The Platform for electromobility will soon propose a document outlining such best practices.

[1]https://www.eea.europa.eu/data-and-maps/indicators/transport-emissions-of-greenhouse-gases-7/assessment

[2]https://www.transportenvironment.org/sites/te/files/publications/2020_10_Dataforce_company_car_report.pdf

[3] EU Commission Expert Group on Clean Bus Deployment; D2 Procurement and Operations.

[4] Flagship 1 – Boosting the uptake of zero-emission vehicles, renewable & low-carbon fuels and related infrastructure

[6] https://www.acea.be/uploads/press_releases_files/ACEA_buses_by_fuel_type_full-year_2020.pdf

[7] In this paper, we include into corporate fleets all “Vehicle owned or leased by a private a company, and used for business purposes.”

[8] https://www2.deloitte.com/content/dam/Deloitte/cz/Documents/consumer-and-industrial/cz-fleet-management-in-europe.pdf.

[10] DG Climate Action, European Commission. https://ec.europa.eu/clima/sites/clima/files/transport/vehicles/docs/2nd_hand_cars_en.pdf

[11] “Accelerating fleet electrification in Europe”, Eurelectric, 2021 (www.evision.eurelectric.org)

[12] Infographic on assessing the feasibility (https://evision.eurelectric.org/infographics/) – with examples of several fleet use-cases / Eurelectric

Our response to the consultation on the revision of the TEN-T regulation

What should be the main focus of transport infrastructure policy at EU level?

In the revised regulation, requirements should

1. prioritize zero-emission technologies and ensure the consistent roll-out of charging infrastructure for all modes of transport to be consistent with the decarbonisation of transport sector and the revised AFID,

2. enabling further digitalisation/automation of transport

3. enhance number and integration of urban nodes in the TEN-T corridors’ governance to ensure consistency between corridors priorities & urban policies for transport decarbonation.

What type of adjustment would you deem most necessary?

– Make the minimum target of 1 charging point/60 km mandatory on TEN-T road networks to ensure their coverage with ultra-fast chargers, incl. urban fast charging hubs

– Direct public funding into the Comprehensive network & outside of the TEN-T network

– Support the ERTMS full deployment on the network as a first step to digitalise railway operation & improve its performance (ATO)

– Speed-up Member States’ coordination for cross-border charging and connections

What conditions would you deem most necessary to be extended from the core to the comprehensive network?

– Ensure full coverage of charging infrastructure for all modes of transport on the Core/Comprehensive

TEN-T , and of urban nodes, to reach the decarbonisation of transport and be in line with the revised AFID.

– Support deployment of ERTMS on the Core & Comprehensive Network, and digitalisation of transport

(e.g. development of Automatic Train Operations in rail transport)

– Include requirement on-shore power supply explicitly in the list of priorities for maritime infrastructure

development

Adjustment you deem necessary to strengthen TEN-T implementation instruments?

All implementation instruments should be reinforced to avoid delays that are, in today’s projects, beyond normal level in most TEN-T sites. All proposed instruments should be clearly defined, transparent, proportionate and non-discriminatory In addition, the monitoring of the Member States’ TEN-T guidelines implementation should be reinforced without jeopardizing the implementation targets. Rail investments with CEF 2 funding should be boosted to achieve the 2030 and 2050 TEN-T deadlines.

Are there other measures concerning infrastructure quality and resilience that could be considered?

Cyber-threats are an area of concern for railways which have complex interdependences and legacy infrastructure. Electrification and smart mobility must be considered in light of the cyber security threat that comes along, taking into account the increasing interdependency of the various components and actors of the EU interconnected power system. The TEN-T revision should incorporate the key elements of the forthcoming new EU Cybersecurity Strategy

The revision of the TEN-T regulation should strengthen sustainable and multimodal transport. With the surge of EVs, integrating minimum binding requirements per vehicle type would contribute to giving the right

charging infrastructure to the EU. Boosting digitalisation through intelligent services and charging infrastructure is key to make transport efficient, sustainable, resilient but also more user-friendly.

Another focus area should be to recognize the role of active mobility. Infrastructure quality should include requirements regarding active mobility infrastructure. At the same time, in many places the infrastructure is

simply missing. Especially the potential of Electrically Assisted Pedal Cycles (EPACs), and integrating it into the guidelines. The current TEN-T network is clogged by local commuting, on many sections constituting over 90% of traffic. These are often the most expensive sections. Properly integrating cycling into TEN-T would provide a cost-efficient, healthy and sustainable alternative.

Fit-for-55: how to make europe lead on electromobility

The Commission is due to present its “Fit for 55 package” — aimed at achieving a 55 percent emissions reduction by 2030 — in June. The event will launch the political debate, present and bring together various priorities on each of the main files related to electro-mobility by industrial stakeholders.

Keynotes speeches

Julia Poliscanova, T&E

Daniel Mes, Member of Cabinet of EVP Frans Timmermans

Q&A – with keynote speakers

Self-challenging Panel discussion between sectorial stakeholders*

Suppliers- Emilia Valbum, 3M

Manufacturers

– Marie-France Van der Valk, Renault

– Jos Dings, Tesla

Infrastructures

– Arne Richters, Allego

Rail

– Nicolas Erb, Alstom

Energy-

Giovanni Coppola, ENEL X

Wrap-ups

Views of the demand side – Sandra Roling, EV100

*Representatives from the five key industries of electromobility will challenge each-other in an innovative webinar format based on questions sent ahead of the event by attendees.

Electromobility: a green boost for European automotive jobs?

First-ever beforehand presentation of Study on the impact of the shift to electromobility on automotive employment in Europe

The automotive sector is a major employer facing the largest technological transition it has ever known. The automotive industry and its direct supplier represent today more than 6 million European jobs and over 18 million cars. By 2030, at least 30 millions of them will be operating without traditional fuels on European roads. This ambition by the European Union will lead to an unprecedented shift for the automotive industry which has to transform their production from combustions cars to electric vehicles, as well as a high impact on charging infrastructure needs. When Europe will turn to electromobility, what is the impact on the affected jobs within these sectors?

The Boston Consulting Group (BCG), along with the Platform for electromobility, will be present beforehand the result and findings of their recent study on the impact of the shift towards electromobility for the European jobs in the industry. The study covers affected industries from OEM to Tier’s and infrastructure at a European level. The study shows a major shift within the industry. Countries and regions that will be best prepared to capitalize on emerging opportunities by embracing the shift -invest in the new technologies, create a favorable policy environment, invest in re-skilling workers, etc- will have a much higher chance to do so. Those who hold on to the past will be left with an obsolete industry, decreased demand, and face serious unemployment challenges.

Agenda

Welcome Address – Arne Richters, Chair of the Platform for electromobility

Presentation of the results of the Study and reaction from the European Commission

– Daniel Kuepper & Kristian Kuhlmann, BCG

– Frank Siebern-Thomas, Acting Head of the Unit “Fair, Green, and Digital Transitions” DG EMPL

Panel discussion: Capitalize on emerging opportunities

– Marie-France Van der Valk, Renault

– Julie Beaufils, EuropeOn

– Alex Keynes, T&E

– Representative from Trade Union (TBD)

Closing Remarks – Nicolás Gonzales-Casares, MEP (S&D)

Platform's reply on the revision of EPBD

The Platform for Electromobility warmly welcomes the EC’s willingness to revise the Directive on the energy performance of buildings (2010/31/EU, EPBD).

In light of the roadmap and scenarios proposed by the EC, the Platform does not only take a stand for the option 3 but points out that electromobility needs to be addressed as one of the key elements of the EPBD revision if the EU wishes to deliver the objectives set in the Smart and Sustainable Mobility Strategy, the Energy System Integration Strategy and the Renovation Wave Strategy. The deployment of private charging is as important for the growth of electromobility and the decarbonisation of transport as that of charging accessible to the public. The Platform also thinks that the electric bicycles (incl. e-cargo bikes, e-two-wheelers, e-moped and e-cars) should be considered when revising the EPBD.

Given that 90% of EV charging happens at home or in the workplace and that 80% of the EU’s current building stock will still be in used by 2050, the EC must tackle the outstanding barriers to the installation of EV chargers and collective charging infrastructure in all (non-) residential buildings to ensure that all EV users have a “right to plug”. In this regard, art. 8 of the EPBD should be revised.

To that end, the Platform shares its key recommendations.

Set minimum infrastructure requirements for all types of buildings (new and existing)

The EPBD should encourage Member States to implement measures to pre-equip all buildings. The Platform recommends putting in place minimum requirements for the pre-cabling of the installation of EV chargers and ensuring that all buildings will be pre-equipped by 2035.

Guarantee the right-to-plug to all EV users

The revision of the art. 8 of the EPBD must ensure the right-to-plug to all EV users in order to facilitate the installation of charging infrastructure for tenants and properties under shared ownership aligned with Spanish, Dutch and Norwegian legislations and the current EPBD recommendations. In France for instance, condominiums still face barriers when wishing to implement charging solutions due to non-adapted standards.

The EC needs to tackle the remaining obstacles for the installation of charging points in buildings by removing the unnecessary exemptions applied to SMEs and addressing the administrative hurdles (e.g. EV charging as extralegal benefit for employees) as well as collective action problems (e.g. split incentives between EV and non-EV drivers, renters vs. owners, employee vs. employer, etc.). The EC should ensure that the right to plug is as simple as a subscription to other services like internet, phone provider, etc. The request for the installation of charging stations in collective properties should not exceed 3 months. EV users without charging station at home should have a right to plug at work.

Introduce requirements for smart charging

The development of smart charging in buildings is an opportunity for EV users: it ensures a better charging experience, reduces the consumers’ electricity bill1 and could reintegrate the surplus of electricity into the grids (V2G) and/or reuse it in the buildings (V2B). It could also support the uptake of electromobility and can create synergies with renewable energies by integrating them into the electricity grids and providing flexibility services to the system.

Aligned with a definition on smart charging that the Platform urges to be introduced in the revision of the Alternative Fuels Infrastructure Directive (AFID), the existing requirements set in art.8 of the EPBD should be strengthened to support the deployment of smart charging in multi-family and nonresidential buildings in order to provide flexibility services to the power system via EV connection to the grid and to buildings.

The EPBD must be revised in coherence with the AFID to ensure the same level of ambitions in both texts and a coherent framework for the deployment of charging infrastructure across Europe. In line with the Renovation Wave, the EC also needs to ensure that funding and recovery plans tackle the rollout of smart charging infrastructure in the building renovations. A long-term funding programme (about 10 to 15 years) for local authorities and governments could be developed for example and channelled through the Member States to support the cabling of residential and office buildings’ in all parking spots.

Our vision on the future of Eurovignette

- General Comments

Establishing a level playing field between all modes of land transport requires an ambitious revision of the Eurovignette directive. A level playing field across single market will then allow the development of a clean transportation system in Europe. Both rail and Zero Emission heavy duty vehicles ZE HDVs) will benefit from it, therefore reducing the impact of land transport on the environment. Revising the Eurovignette directive is therefore a necessary step towards 2050 climate objectives.

Two aspects of the new Eurovignette directive can have a true and significant impact on the deployment of ZE HDVs: external cost charges for air and noise pollution on the one hand, and improving the CO2-based tolling system on the other. Internalization of cost and an improved tolling system will significantly reduce CO2 emissions. The distance-based infrastructure charging coupled with CO2 differentiation is the ideal for incentivizing cleaner vehicles. Here external cost charging is crucial as well as the application of the “polluter pays” principle.

This reaction paper presents the Platform for electromobility’s point of view vis-à-vis the positions adopted by the European Parliament and the Council. Although ideally the “polluter pays” principle will be applied in all modes, the paper provides the realistic expectations of the electromobility sector to actors in the trialogue negotiations. This paper complements a precedent paper issued after the Commission’s proposal in 2017.

Air & noise external cost charges

Based on ‘user pays’ and ‘polluter pays’ principles, road charging will make logistic cleaner and limit transport’s climate impact. The Platform for electromobility supports the Parliament’s position on air and noise external cost charges (Am. 68). This support is conditional to:

Air and noise pollution should always be considered together. External cost charge shall be applied for traffic-based air and noise pollution to HDVs by Member States levying tolls. The fight against one pollution type should not be at the expense of the other. Applying external cost charge to either/or of these two pollution types would contradict the ‘polluter pays’ principles. (To avoid any doubt, an external-cost charge for air and noise pollution should not be added as a choice that would rule out varying the infrastructure charge for CO2).

The Platform promotes external-cost charging – in principle for all vehicles – by reducing scope for exemptions. External cost charge should not be limited to HDVs and to “vans intended for carriage of goods”. Road charging will then contribute to an efficient transport system, where prices reflect the true external costs of logistic. It will thus give clean options, such as electric road vehicles but also trains, a level playing field to compete. It will also reduce risks of switching between vehicle categories (e.g. trucks to vans).

Finally, external-cost charging should be made mandatory for HDVs on all tolled roads within the scope of the directive from April 2023 (the same time as CO2 variation becomes mandatory on these same roads).

The Council’s position however raises concerned about the certainty of the application of various measures. Indeed, the text proposed by the Council leaves a great deal of discretion to the Member States to grant exemptions. It makes pollution charged only mandatory “where environmental damage generated by heavy duty vehicles is the most significant” (italics added). Because the terms “the most significant” are not defined to ensure the enforceability of the provision, the Platform suggests removing this condition and making an external cost charge for traffic-based air and noise pollution mandatory for HDVs on all tolled roads.

Any exemption to apply air and noise external noise costs on the tolled network should be very limited. Additionally, the burden must shift to MS to supply to the Commission the information backing the decision not to charge any particular road section in each case. Diversions can be an example of a very limited exemption. Such an exemption could be allowed where a MS is able to demonstrate that adding air and noise external costs on a particular road section would likely and significantly increase the number of freight vehicles diverting to use a non-tolled alternative.

CO2-based tolling

The Eurovignette should not be only about the stick but also about the carrot: shifts to cleaner vehicles should be somehow rewarded. The Platform therefore welcomes the toll reduction for “CO2 emission class 5 – zero-emission vehicles” (ZEVs) from 50% to 75% applicable from April 2023, noting that a toll reduction of up to 100% can be given until the end of 2025. An adequate, clear, easily-applicable tailored methodology should accompany these measures, based on E.U. emissions standards, in order to provide visibility and transparency in road charging schemes.

Beside, on LDVs, the CO2 variation of tolls should remain mandatory as proposed by the Commission.

Finally, the Council proposed a well-developed and balanced, system of CO2-based tolling which could be embraced almost entirely, adding the following improvements:

- Secure mandatory re-classification of emission class 2 and 3 vehicles after 6 years – not merely an ‘assessment’ as currently provided for in the Council GA.

- Ensure more time certainty regarding the timeframe for emission classes 2 and 3; [X] on p47 of the GA should be 6 months.

These two improvements are important. The first would help to differentiate classes in a future proof manner because without mandatory reclassification, there would be failure to keep pace with the linear emissions reduction trajectory upon which the truck CO2 standards are based, and Member States could take conflicting approaches to trucks six years after their first registration. Second, time certainty is important for emission classes 2 and 3 so that truck sellers and buyers have clarity over the likely toll costs of planned vehicle sales/purchases. With investment certainty, more sustainable purchasing practices and technologies are incentivized.

A revenue neutral approach

Distance-based infrastructure charging, when coupled with CO2 differentiation outlined in the previous section, is ideal for incentivizing the shift towards cleaner vehicles.

The Platform supports revenue-neutrality for the CO2 differentiation of tolls as outlined in 7g4: “The variations referred to in this Article shall not be designed to generate additional revenues”. To show relevant variations over time, annual reporting by Member States should also include toll revenues per vehicle-km, by weight and axle category (art. 11.2f).

The intended effect of the CO2 differentiation of tolls is to incentivise users to switch to cleaner vehicles, leading to decreased tolls for zero emission vehicles in particular. Such a decrease is to be offset by a higher level of tolls (average toll rate), in respect of ‘user pays’, but also for the sake of fair competition with other transport modes such as rail.

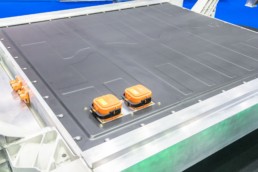

Platform’s feedback to the consultation Batteries – modernizing EU rules

The Platform welcomes the proposal for a Battery Regulation and strongly supports the need for modernisation of the existing batteries legislation. It must ensure harmonisation in the internal market and facilitate an accelerated shift to electrified mobility by engaging all parts of the battery supply chain. The regulation must establish proportional and well-designed provisions to enable sustainable battery production, use, and end-of-life management.

Generally, the timeline for the provisions should be well-thought through to ensure robust and harmonised application and enforcement. We need to strike a balance between the need for a quick implementation of the Regulation while ensuring a robust methodologies. Overall, the proposed measures shall promote cleaner, more competitive and more efficient battery manufacturing.

To avoid duplication or overlaps with existing legislation and requirements and limit excessive administrative burden on the nascent battery industry, the Platform sees a need to streamline and align provisions.

Read the PDF version here

While the Platform believes that the proposed requirement for carbon footprint declarations goes in a positive direction, we are concerned about the measure’s enforceability at the Member State level. Provisions should apply per battery model and manufacturing plant instead of “for each battery model and batch per manufacturing plant.” Rules on enforcement, methodology, and electricity accountability should also be clarified, to ensure:

1. Harmonised enforcement at Member State level and for imported batteries;

2. The use of representative data and supply-chain configurations to ensure comparability of declarations. E.g certification of energy use should reflect real world use of renewable energy and must not rely on purchase of green certificates (Guarantees of Origin).

3. The confidentiality of the declared primary data is respected.

The Platform strongly supports the introduction of rules for the responsible sourcing of raw materials for batteries. Similar due diligence requirements must also be applied as soon as possible to the fossil fuel sector as part of the upcoming horizontal due diligence legislation.

The Platform highlights that economic operators must have sufficient time to adapt to new data sharing requirements. The chosen method, be it battery passport or QR Code, should be streamlined with a focus on a single, innovative, and digital approach. The Commission must identify which data sets are essential to boost the data-sharing economy while ensuring confidentiality.

The Platform welcomes the Regulation’s intention to provide a regulatory framework for the transfer of liability and safety requirements for second-life EV batteries. The current provisions, however, require clarifications as regards access to BMS, conditions for the safe treatment of batteries, property rights protection, as well as ownership of data created by EVs. Moreover, the waste status of batteries is vital: the collection of waste batteries potentially suitable for repurposing should be designed in such a way that a second life business model can develop without creating a free pass for illegal waste transport. In particular, a clear-cut transfer of extended producer responsibility is pivotal to avoiding the risk of illegal export.

On end-of-life management, we welcome the recognition of batteries within a circular economy. Also, the Batteries Regulation now better differentiates between battery chemistries. However, the future regulatory framework should be aligned and consistent with EC 1907/2006 (REACH). To work towards a level playing field, we propose including a deadline for the adoption of equivalent conditions criteria for export of waste batteries to third countries. Minimum recycling conditions outside Europe must be set, including environmental and social criteria.

Guidance Note on "Recharge and Refuel" Flagship un the Member States recovery plans

Read and Share the PDF version here

Introduction

Last year, the electric car market reached a tipping point in the EU with sales surging to 10,5% on average. However, to meet the EU climate goals and achieve the target of 30 million zero emission vehicles on the road in 2030 set by the EU Smart and Sustainable Mobility Strategy, steep the acceleration in the sales of electric vehicles (EV), the deployment of EV charging infrastructure and the extension of public transport is necessary. The European Commission has set the objective to reach one million public chargers in 2025 and three million in 2030 and thus the fair contribution of each Member State (MS) towards reaching that target is key.

As part of the Recovery and Resilience Facility (RRF), the EC strongly encourages Member States to put forward investment and reform plans on the so-called ‘Recharge and Refuel’ flagship. This flagship is identified as one of the areas for investments and reforms with tangible benefits for economy and citizens across the EU[1].

In order to make climate objectives and tap on the benefits of clean and cheap electromobility, it is essential that Member States place a strong focus on the ‘Recharge and Refuel’ flagship in their recovery plans. Both private, commercial and public charging infrastructure for cars and vans as well as public transport infrastructure should absolutely be on top of the agenda, while charging infrastructure for heavy commercial vehicles should also be clearly targeted. The electric truck market, from commercial urban vehicles to long-haul trucks, is expected to ramp up quickly in the next years which means that financing and funding support are necessary to support the rollout of the dedicated charging infrastructure: at the depot, at the distribution centre and at public locations, being it urban areas or along highways.

Given that charging infrastructure is disproportionately concentrated in 4 countries, special attention should be paid to ensure that new stations funded under the NextGenerationEU program are more distributed and that the proper ambitions are expressed in all MS proposals. That is the only way to reach the 3 million target in 2030 and ensure there is a truly pan-European network for all EU citizens.

Overall, the principle of cost-effectiveness should steer the support towards increased electrification of road transport across all vehicle segments. From small vehicles to heavy-duty trucks with long-range transport applications, the battery technology is proven to be the cleanest, most energy-efficient and competitive alternative for the long-term and should therefore be prioritised in the road transport decarbonisation plans of the Member States.

This Guidance Paper provides some recommended elements that Member States should prioritise in their recovery plans and that the EU evaluators should look for in evaluating MS plans. The Platform for Electromobility strongly feels that these elements are key to ensure that the deployments under the RFF meet the needs of EV drivers and public transport users across the EU and to form the necessary trigger for accelerated private investment. It is essential that Member States place a strong focus on the Recharge and Refuel Flagship in their recovery plans and prioritise RRF funds towards charging infrastructure.

To make sure public funds are allocated in the most targeted way, the Platform believes Member States should develop national e-mobility and related infrastructure masterplans, which include ambitious deployment targets for both vehicles and infrastructure and form the basis of the allocation of the public investments. These plans and targets will provide the necessary trigger for private investment.

- All types of locations and all use cases should be targeted

In order to ensure that the Recharge and Refuel Flagship proposals in the Recovery and Resilience Plans submitted by MS achieve the goals laid out by the EC, it is critical that they look broadly at all the opportunities and locations where charging infrastructure and electric road system can be deployed. Investments should also target national EV charging networks for long distance travel. Specific support should also be considered for operators looking to invest in charging deserts. We elaborate on some specifics in the next two points:

- Private, semi-public and public charging

The major growth areas for EV charging are workplace and community locations, including multi-unit buildings and (semi-)public charging in residential neighbourhoods. In many cases, especially shared private facilities, private charging infrastructure performs the same function as public infrastructure, being accessible to multiple users. MS plans must prioritise significant EV infrastructure deployment at these types of locations, based on their national needs’ assessment and ambitions. In this regard, a close collaboration between national and local authorities in developing such plans is key to steer recovery funds towards relevant investments needs for charging infrastructure.

- Develop and modify local building codes to provide specific rules and guidance around the deployment of EV charging infrastructure in new and existing buildings.

- Set a pre-installation requirement of EV charging infrastructures in the design of new buildings and a specific requirement for community infrastructures which enable smart charging.

- Support the “right to plug” so that interested tenants in a building have the standing to request an EV charging station in their building/at their parking space and simplify the administrative procedure for the installation burden is on the municipality or other responsible parties to object, and planning funds are available.

- Address the “first mover” problem by earmarking funds to support the wiring and cabling of the shared/communal portions of new and existing buildings.

- Make public funds available for some private and semi-public charging infrastructure, where it supports a whole group of users (such as employees of a company, vehicles in a depot, tenants of a building, visitors to a building, etc) – i.e. more than just the single owner of the vehicle.

- Destination charging at public parking facilities (e.g. shopping malls, sports facilities, restaurants, hotels, etc.) are essential and should also be supported.

- Do tendering processes in a way to support open markets and optimal service delivery and ensure the best companies for installing and operating EV charging infrastructure are selected through a fair and competitive process.

- Take into account the extension of public transport infrastructure (e.g. for electric buses) in MS plans.

- Dedicated focus on electric trucks, which yield the greatest synergies

Fully electric heavy-duty vehicles (HDVs) are very much a reality and already driving on European roads. The number of these will rise quickly in the years to come. Member States must plan for this by deploying the proper infrastructure.

By planning for the growth of the battery electric vehicles (BEV) HDV’s, Member States can also generate the greatest infrastructure synergies, as in some cases these hubs can support a range of high and lower power users.

- Funds should be used to encourage the creation of high-powered charging hubs to support HDVs and other users should be planned and developed on main roads and highways, at rest areas, near off/on ramps around logistics hubs, and at depots

- Funds and plans must consider the state of the electricity grid and the need to either extend or upgrade it or provide options for local onsite generation from renewable energy sources coupled with onsite storage.

- Grid capacity should be factored in decisions to build or upgrade a truck resting area to facilitate such high-power charging (e.g. megawatt chargers). This could help lower deployment costs and accelerate grid readiness for e-trucks to come.

- Deployment and investment decisions should be based on data and real conditions

Proper planning for charger deployment and (possible) grid improvements require data to inform those decisions. Data on existing charging stations and grid conditions should be made promptly available (to municipal, regional authorities and relevant industry actors).

- To prepare such a plan properly, data is needed to understand the situation now, needs and gaps

- Funds must be made available to support MS in gathering this data.

- The capacity building of grid operators to be part of local infrastructure planning should be enlarged. The process of involving DSOs could include municipal, regional and highway charging infrastructure planning, the development of best location-plans with information on grid capacity and reinforcement needs, with information on costs being made available to all relevant industry actors directly involved in establishing the business case of the operation of the infrastructure, while respecting all data privacy requirements.

- For proper infrastructure deployment planning purposes, data is needed to map:

- Current infrastructure (in Charge Point Equivalent terms)

- Geographic coverage and gaps

- Available power levels

- Accessibility of stations

- Grid capacity (overall and at precise locations)

- The grids should be prepared for increased EV integration

The MS plans should require distribution grid connections and available capacity to be future proof, by defining minimum standards which will be necessary for the upgrading and the extension of the infrastructure network, both in urban and rural areas.

- Grid capacity upgrade support should be factored into decisions to build hub areas, commercial parking spots, or resting areas to facilitate high power charging. This could help lower deployment costs and accelerate grid readiness for different types of vehicles, from ride-hailing vehicles to e-trucks.

- Sufficient tools should be given to distribution network operators to operate the grid in the smartest way possible; time-varying network tariffs aimed at shifting EV network use away from peak hours in order to reduce the need for grid reinforcement for example can help to address grid capacity or congestion challenges at particular locations.

- Interoperable infrastructure should be embedded and roaming enabled

The adoption of open, non-discriminatory and interoperable communication standards in EV charging infrastructure as a key requirement is fundamental to facilitating a seamless charging experience for the driver across national EV charging networks, but also across borders.

Publicly accessible charging infrastructure at commercial or public locations should never be locked into an equipment or network provider, either commercially or technically. Any publicly financed charging stations under the RRF should therefore require open protocols and standards for the backend communications and for enabling smooth roaming. This will help to encourage and accelerate the uptake of EVs and address availability concerns by EV drivers.

At the same time supporting infrastructure that enables roaming on publicly accessible charging stations will allow drivers to charge at stations belonging to the network of another operator (not their “home” operator) with a single subscription provided by a mobility service provider. This applies both within and across national borders. The MS recovery plans should therefore steer eligible publicly accessible charging stations to require the use of the open, roaming communication protocols to facilitate roaming agreements.

- Smart-charging should be future-proof

EVs could help realising the EU’s renewable energy objectives by increasing the share of RES in the network through smart charging. Future charging stations should be prepared to deliver a basic level of smart charging services, e.g through load balancing and time of use, in particular in regard to private charging at home and/or in residential areas when there is not possibility for EV users to install a charger in the building. It will be important to work towards a situation in which smart and bi-directional charging are standards applied in practice in the coming years. The plans should therefore include smart charging incentives:

- Incentives should focus on supporting the business case for smart charging, for instance by facilitating variable time-based pricing policy, but not prescribe technical means to achieve this additional capability. These facilitating measures should focus on increasing the willingness of consumers and their ability to participate in smart charging.

- Support could also cover the risks in business cases of market parties in the roll-out and/or the operation of smart- or bi-directional charging infrastructure.

- Support should be steered towards future innovations, such as smart charging and state of the art system integration technologies, including vehicle-to-grid (V2G) capability.

[1] European Commission (2020), EU Recovery and Resilience Facility: https://ec.europa.eu/info/business-economy-euro/recovery-coronavirus/recovery-and-resilience-facility_en