Our recommendations on due diligence initiative for a sustainable transition to electric mobility.

Due Diligence

for a sustainable transition to electromobility

The Platform for electromobility advocates for a sustainable mobility approach that protects the environment and human rights. To achieve this, coherence between legislative files will be key. The following steps should be taken on the Battery Regulation and the upcoming horizontal initiative on mandatory Human Rights and Environmental Due Diligence (mHREDD), while bearing in mind the difficulties encountered in implementing similar legislation, as was seen with the Conflict Minerals Regulation (CMR).

Strengthen and mirror the Battery Regulation’s provisions on due diligence

The Platform strongly supports the introduction of binding corporate responsibility rules within the Battery Regulation for due diligence throughout the battery supply chain. As this Regulation is likely to act as a framework for regulating other complex products arising from the mobility industries, the Platform therefore invites the Commission to strengthen the due diligence requirements.

Europe’s new level of ambition for due diligence on batteries should be mirrored in any upcoming legislation that impacts other transportation industrial sectors and their supply chains. Both zero emission and traditional combustion transportations should face equivalent strict requirements. Those common or equal obligations should cover the entire supply chain of an economic operator, including its business relationships and subsidiaries. Economic operators should have clear environmental responsibilities, addressing risks such as water contamination, air pollution, biodiversity. This should also be the case for human rights, addressing risks such as child labour, forced or unpaid labour and the freedom of association of workers and so on.

Horizontal initiative on mandatory Human Rights and Environmental Due Diligence (mHREDD)

The Platform supports the overall objective of the mHREDD Directive, as well as the opportunity to boost investment crucial for the electromobility transition: productions sites, innovation as well as employee retraining, upskilling and reskilling.

However, it is important the European Commission proposes an ambitious horizontal mHREDD, to match – at minimum – the Battery Regulation on the due diligence requirements included in Art. 39 and Annex X. If the due diligence requirements in the Battery Regulation are strengthened by the co-legislators – a step we are calling for – the gap between the new battery industries and traditional ICE producers would keep growing, undermining the growth potential of the former.

The mHREDD requirements should therefore be extended to those sectors that compete with electric transport. In particular, due diligence requirements must apply equally to the fossil fuel sector. This would provide consumers and authorities with full transparency on the diverse mobility options available on the market. In addition to the excessive complexity created by double standards, an unambitious mHREDD would not deliver the level playing field between competing industries, consequently slowing down the transition to electric mobility.

Companies falling within the scope of the mHREDD should be liable for human rights and environmental harm they – or a company they control or have the ability to control – have caused or contributed to. This range of control should be clearly defined.

On the impact on prices, costs may increase due to new requirements on suppliers. They will either adapt their production accordingly or will pull out of the EU market, thus restricting the sourcing possibilities for European manufacturers to more costly suppliers. Establishing ambitious environmental and social standards via supply chain due diligence rules will, however, enable batteries and vehicles manufacturers in the EU to compete globally on elements other than price alone.

Finally, implementation of the mHREDD should be harmonised throughout EU to avoid double standards and divergence between Member States. A Regulation is necessary to create unambiguous guidance for transnational companies on the methodologies. Any uncertainties – particularly on implementation, scope, certification and auditing – should be avoided.

Word of Warnings from the implementation of Conflict Minerals Regulation

Reflecting on the experience of the implementation of CMR – which legislates on a very specific set of minerals – is essential for ensuring the effective implementation of the horizontal mHREDD and of the Battery Regulation. We urge legislators to take all steps necessary to tackle the difficulties of implementing and enforcing all EU due diligence policies in all sectors, particularly for other critical materials for the transition of electromobility.

Considering that the basic components of the CMR are taking a significant time to implement, the Platform is concerned by the feasibility for the European Commission to enforce Art. 39 of the Batteries Regulation and upcoming mHREDD. The Platform for electromobility underlines the following challenges to ensure provisions can genuinely be enforced. New measures should:

- Address delays in recognising industry schemes, which are at the core of the CMR, without compromising a thorough auditing process of the applying scheme.

- Rely on concrete outcomes rather than on reporting, as is the case for the CMR.

- Ensure responsibility falls on the user placing the minerals on the market (i.e. OEMs in the case of transport industry), rather than on their Tier 1 or 2 suppliers, in order to get closer to the end users.

Our key findings and recommendations to make the European Green Deal an employment success

Executive Summary of the study “E-mobility: a green boost for European automotive jobs?” for policy makers

The Platform for electromobility has facilitated a report (and data set) – undertaken by the Boston Consulting Group – on the impact of the shift to electric vehicles production on automotive jobs in Europe. The Platform for electromobility represents 45 organisations from industry, civil society and cities that employ around 650,000 people globally.

This study takes a deep dive into the likely opportunities and challenges that will be created by the transformation of the automotive industry in the coming 10 years. Ensuring that workers are guided and accompanied through this transition will be the key to the success of the industry and to preparing them for the jobs of the future.

Key findings: a comprehensive and inevitable transformation

The automotive industry was deeply impacted by the COVID-19 crisis, and will likely need several years to reach pre-pandemic levels of production and profitability. Prior to the pandemic, manufacturers were producing approximately 17.7 million light vehicles in Europe with an overall production value of approximately €700 billion.

The study shows that the industry will rebound, with a shift from internal combustion engines (ICEs) to electric vehicles (EVs). By 2030, some 59% of sales in Europe will come from electric vehicles (70% if plug-in hybrids are included). Alongside electrification, digitalisation will be the second pillar underpinning the carmakers’ recovery: the study projects that the value of software included in cars will increase by 11% each year. Based on the projected volumes of production and sales for 2030, the study concludes that – across the 26 industries within scope of the research, which represent 5.7 million jobs – overall employment is forecast to remain essentially stable compared to the 2019 baseline, with minimal variations in job numbers. Although electrification will contribute in part to these slight variations, the study predicts that EVs will have only a minor net impact on jobs through to 2030, contrary to what some observers expect.

This relatively small net figure should not, however, obscure the massive structural changes resulting from the shift to electrification. Changes in production will modify both the skills requirements and distribution of labour. Over the decade, direct employment in carmakers and ICE-focused suppliers will decrease by 5%, while adjacent industries’ workforce – such as those in energy production and charging infrastructure – will increase by 34%. This transfer from core automotive industries to adjacent industries is examined in detail in the report. It shows that – with more than 580,000 new jobs created by shift to EVs – production of these vehicles will be the main driver for job creation in the automotive ecosystem.

On top of these jobs, a further 40,000 will be created each year by construction and civil works for adapting energy production and distribution infrastructures. Without the shift to EVs, these economic opportunities would not exist at all. The study also expects electromobility to act as a catalyst for further activities in other adjacent sectors to the automotive industry. In the energy domain, we expect 60,000 new jobs to be created.

Overall, the effects on employment in the core automotive sectors caused by the product changes arising from the EV shift will be compensated for by new opportunities created by the electromobility ecosystem. These will be driven, for example, by growth in battery production and charging infrastructure. This finding is all the more significant given that a failure to electrify would likely lead to competitive disadvantages and subsequent significant job losses across European industry.

The report estimates that, by 2030, 2.8 million workers will need to be hired and the job profile of 2.4 million positions will change, with different degrees of training needs to prepare them for future job demands. By 2030, 42% of all employees in the core automotive and adjacent industries will have dedicated training needs. Specifically, 1.6 million will require retraining, while remaining in their current position; another 610,000 will need requalification while remaining in the same industry cluster; 225,000 people will need support to requalify for work in other industries outside the automotive ecosystem. Some of this impact will be felt at local or regional levels, so it is vital that governments provide policies to help those regions adapt to the coming change.

Our recommendations: The need for a robust framework to master the transition

The transition to electromobility does not pose a threat but rather an upskilling opportunity for workers. With the correct political and regulatory choices, the outlook is bright for one of Europe’s strategic industries and its workforce.

It is vital to support workers during this transition to electromobility: the EU, governments and companies should prioritise programmes that invest in the education, training, upskilling and reskilling of the labour force to capitalise on new opportunities, raising the bar on employment conditions, to ensure no one is left behind. This will be an investment for future generations and for the environment.

The Platform welcomed the ambitious ‘Fit for 55’ package unveiled in July, but the social changes this will trigger should be tackled with similar levels of ambition. A fair Green Deal must empower companies, governments and regional authorities to equip the workforce with new skillsets.

European Institutions: Workers in the automotive sector should benefit from a policy framework similar to that already flourishing in the energy-intensive industries, thanks to the Just Transition Fund, Just Transition Platform and Just Transition Mechanism. This new policy framework should assist industrial stakeholders, local, regional and national authorities in accomplishing the following steps:

Industrial stakeholders: For employers – and notably carmakers – support will be needed to design requalification and upskilling programmes and hiring as well as restructuring programmes. Battery manufacturing and the deployment of infrastructure both for distribution via charging stations and production via renewable energy will be a core provider of jobs during this transition. Their rapid growth should be underpinned by ambitious regulations and targets. Support should be provided, particularly for small- and medium-sized enterprises during the transitions, as they will lack the analytics and training resources of bigger companies.

Local and regional authorities: Behind these numbers lie human lives and territories where they live. Relocations should thus be avoided where possible by adapting existing production plants, and training for new skills where they are needed. Local and regional authorities will play a key role in addressing the knowledge gaps in the workforce both for EV production and for the full EV system and value chain. The new ESF+ should be an instrument for supporting local and regional authorities in this field.

National governments: Governments need to perform holistic, ‘whole-of-economy’ workforce planning at a national level. This needs to be done in close cooperation with regional and local authorities as well as industrial stakeholders, and must include advanced models for supply and demand, such as:

- Helping employees manage their transitions. It is essential to rethink education and reskilling and provide additional initiatives; the main challenges, such as the need to requalify workers for a different industry, should receive the highest priority.

- Tailoring educational curricula appropriately. For young people entering education, Governments will need to gear them – and for job seekers – towards new automotive technologies.

- Building new career and employment platforms. The public sector should help workers to navigate to jobs and training opportunities more quickly and easily.

- Updating social safety nets. These will need to be revised in order to promote up- and re-skilling during transitions, as well as supporting part-time workers and those people unable to adapt to new challenges.

They reported our study:

-

Reuters: https://www.reuters.com/article/autos-europe-electric-jobs-idINKBN2GN26J

-

Politico : https://pro.politico.eu/news/politico-pro-morning-mobility-vw-compensation-pressure-imo-climate-neutrality-call-fit-for-55-costs?utm_source=POLITICO.EU&utm_campaign=bfe97b311b-EMAIL_CAMPAIGN_2021_09_29_04_59&utm_medium=email&utm_term=0_10959edeb5-bfe97b311b-190774208

-

Ends Europe : https://www.endseurope.com/article/1728880/ev-transition-will-minor-impact-total-auto-jobs-study-finds

-

Euractiv: https://www.euractiv.com/section/electric-cars/news/shift-to-evs-means-huge-reskilling-job-for-europe-report/

-

Automotive News Europe: https://europe.autonews.com/automakers/shift-evs-means-huge-reskilling-job-europe-study-says?utm_source=daily&utm_medium=email&utm_campaign=20210928&utm_content=hero-headline

-

Yahoo Finance: https://au.finance.yahoo.com/news/shift-evs-means-huge-reskilling-220920083.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr&guccounter=1&guce_referrer=aHR0cHM6Ly90LmNvLw&guce_referrer_sig=AQAAAJrlwm12aslHP0qvGsu8voim-hoYJP2N9ur-AIvpgwL_Od1kwmrZUxk8yoc0amUzdOmXbfK66OWJ9jy0G1vdaLp9GesVGoKUybo_vJjaTEJ5YBosvGpbArsBwezSDMOcmW61uC4zosOHkYjW3Qxl44tzETmYU5DVyJqIfLevbmFx

Denmark

China:

-

MSN: https://www.msn.com/zh-tw/money/topstories/%E6%A2%85%E5%85%8B%E7%88%BE%E5%9C%A8%E4%BD%8D16%E5%B9%B4-%E5%BE%B7%E5%9C%8B%E6%95%B8%E4%BD%8D%E6%95%99%E8%82%B2%E5%8C%B1%E4%B9%8F-%E6%8A%80%E8%A1%93%E8%90%BD%E5%BE%8C%E7%89%B9%E6%96%AF%E6%8B%89/ar-AAOTh2w

-

Technews: https://technews.tw/2021/09/28/merkel-reigned-for-16-years/

-

Shenzen Daily: http://www.szdaily.com/content/2021-09/29/content_24610041.htm

UK

-

UK Investing: https://uk.investing.com/news/commodities-news/shift-to-evs-means-huge-reskilling-job-for-europe--report-2472496

-

Business Fast: https://www.businessfast.co.uk/shift-to-evs-means-huge-reskilling-job-for-europe-report/

Italy

InsideEV Italia : https://insideevs.it/news/536915/auto-elettrica-posti-lavoro-bcg/

Private Policy

By registering you agree that the Platform for electromobility, and only the Platform for electromobility, use the provided data to communicate future events organized by it. The provided data will by no mean be shared outside the Platform for electromobility secretariat.

To optout but stay register for the current event, please send "stop" to theo@platformelectromobility.eu

Our answer to the Revision of the Combined Transport Directive – Inception Impact Assessment

Combined Transport Directive

Our answer to the consultation

Directive 92/106/EEC is the only EU legal instrument directly targeting combined transport (CT), incentivising a more sustainable operational model for freight transport. Nearly thirty years later, the effectiveness of the Directive needs to be improved as the freight market and transport have gone through considerable changes. Furthermore, the political context has shifted as well, with an increased ambition on emissions-reduction objectives deriving from the European Green Deal and the Sustainable and Smart Mobility Strategy.

The Platform for Electromobility agrees with the European Commission that, without an intervention to promote the use of multimodal transport, the uptake of more sustainable transport options will not take place to the desired degree and in the desired time-frame to reach 2030 and 2050 EU objectives.

Strengthening combined transport fits perfectly into the vision of an integrated and sustainable comprehensive mobility system. The role of intermodal terminals, in this context, stands out through the optimisation of the connectivity of the different modes, and incorporating rail, roads and waterway systems into the freight logistics chain.

Among the options envisaged by the Inception Impact Assessment, Option 3 appears as setting the most effective way to crucially improve the framework for combined transport in Europe. The extension of the support from today’s narrowly defined combined transport operations to all intermodal or multimodal operations, and the categorisation of terminals based on infrastructure and operational efficiency – both proposed also under Option 2 – would broaden the Directive’s scope and streamline investments for combined transport’s infrastructures.

Moreover, Option 3 foresees an assessment of the efficiency of the measures to support the attainment of the objectives of the revised Combined Transport Directive. This measure would improve the reporting and monitoring conditions of the Directive.

Following this further, the Platform remains cautious about the viability of Option 4, which envisages mandatory harmonised support measures – such as a support to transhipment costs. Such proposal may open the door to state aid-related questions and be challenged across Member States.

The Platform for Electromobility looks forward to work with the European Commission to ensure that freight transport do not miss the decarbonization revolution and contributes efficiently to a sustainable, integrated and multimodal mobility system for Europe and set best practices for the world.

Mandating zero-emission vehicles in corporate and urban fleets: guidelines for reflection for policy makers

In a previous communication,

the Platform for electromobility,

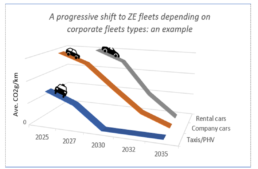

an alliance of 45 industries, NGOs and associations covering the whole value chain and promoting the acceleration of the shift to electric mobility, called for a new single regulation dedicated to the complete decarbonisation of corporate fleets. Such fleets represent 63% of new registrations and, on average, drive more than double the number of kilometres of private cars. The largest leverage for CO2 reduction with reduced political risks. The Platform recommended adopting a gradual approach to eventually reaching the objective of 100% of new vehicle purchase in corporate fleets being fully electrified by 2030.

This paper follows up on the previous communication paper with the aim of providing policy makers with the information and figures to support the drafting of such new legislation. The elements presented below are intended to aid reflection on enshrining in law and implementing the EU Smart and Sustainable Mobility Strategy’s “actions to boost the uptake of zero-emission vehicles in corporate and urban fleets”. This commitment can be made concrete through a new EU legislative framework that mandates the transition to ZEVs (Zero Emission Vehicles) for company cars.[1]

A consensus on a regulation

Although the variables of such new legislation are being debated within industries and sectors, it is certain that a Regulation, rather than a Directive, is essential for a range of reasons. A Regulation will:

- Stimulate deployment of electric mobility in those countries where uptake is currently slowest. The logic for better-harmonised measures at the EU level arises from the need for the same level of effort against climate change within all Member States.

- Avoid the delays in implementation that a Directive might entail – such as can currently be seen with the Clean Vehicle Directive. With the climate change clock continuing to tick, the time needed to conclude negotiations on a Regulation would be compensated for by the inevitability of its direct implementation. A Regulation will reduce the transition time to electric mobility between those Member States that have already announced the phase-out of ICEs by 2030 (such as Sweden, Denmark, Netherlands, and Ireland) and others.

- Bring certainty to both EV manufacturers and those companies purchasing targeted fleets. Such certainty for manufacturers, along with ambitious CO2 emission performance standards for new cars and vans, will ensure that the supply of EVs meets the EU climate ambitions and avoid companies competing for a limited supply of ZEVs.

- Introduce stronger safeguards than a Directive against potential Member State market distortions, notably in the form of unfair price increases for the private fleet owners.

Variables to consider within the Regulation and potential options

That said, a range of options for the Regulation mandating ZEVs for company cars can be considered. These include regulation application threshold, timeline, average fleet consumption or a mandate on new purchases, etc. Below, the Platform provides examples from the debate within certain Member States.

Application threshold:

There must be a balance struck between covering a large proportion of company cars in Europe while not overly impacting smaller companies, where such a mandate could become an excessive financial and administrative burden.

The Platform proposes to target the largest companies first, as it is possible to mandate the electrification of most company cars. Table 1 shows the share of company cars in Spain managed by companies, according to the size of their fleet. For example, by mandating companies managing 20+ vehicles (i.e. medium and large companies, representing only 6.8% of the total), it would be possible to electrify 55.2% of all company cars. France has already chosen such an approach (this example is detailed in Annex I of this paper).

As well as making the greatest impact with the lowest burden on the economy overall, targeting the largest fleets first would also make the implementation and enforcement of the legislation more efficient. It is easier to control and scrutinise large entities with dedicated fleet management services than it is for microenterprises. Establishing a distinction between private and business use of corporate vehicles for these smaller companies would entail onerous and disproportionate costs and an excessive administrative burden in keeping appropriate records.

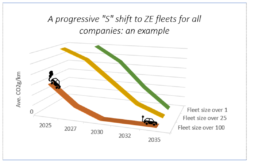

Application timeline:

This approach would allow the adoption rate to follow an ‘S-shape’ curve, with a slow increase to 2025 due to difference in the cost acquisition of ZEVs. After 2025, and with price parity between ICE vehicles and ZEVs, the adoption rate will begin to accelerate. An EU target will provide a clear threshold for companies, while leaving flexibility for those Member States that seek to move faster towards their goal. Ideally, the mandate would apply to the fleets of the largest companies before applying to smaller fleets, given that – as time goes on – the acquisition cost of EVs will diminish and more charging infrastructure will become available.

In order to avoid social backlash, the objectives of emission reduction for 2030 were set at a moderate level. Acting more rapidly on company cars during the period 2025-30 with more ambitious levels would allow a significant impact on decarbonisation while avoid impacting those with the lowest incomes. Small- and medium-sized enterprises should be supported during the transition, as they lack the analytics and training resources of bigger companies.

Transition pace:

The steepness of the transition curve is also an element that needs to be considered. To make all newly procured corporate vehicles zero-emission by 2030 will require rapid uptake. To achieve this, there are different potential pathways (linear growth, exponential growth, ‘S-shaped’ curve, etc.), for which the efficiency, fairness and preparedness should be assessed in the impact assessment.

Enforcement, incentives and penalties:

In order to enforce the legislation, a first step would be to establish a clear reporting system to keep track of new procurement. As a next step, some type of incentive and/or penalties framework should be created. Belgium is an example of an early adopter of such fiscal incentives. The fiscal benefits for ICE company cars will progressively decrease in the country, ultimately disappearing by 2026. Meanwhile, the fiscal benefits for EVs will be maintained. In France, there is a bonus and a premium for conversion that will apply from 2022 with potential renewal.

The levels set for such variables should be discussed with industry and stakeholders throughout the legislative process and consultation phases. This political objective will be translated with specific measures in each Member State. A recent study by T&E has shown how a wide range of measures, mostly fiscal, can be activated at national level. The study showed that, once applied, such measures are effective. If Member States decide not to enforce incentivising measures for companies, then penalties may fall on those companies that fail to comply.

[1] In the document, “company cars” are defined as any passenger cars that are part of a larger fleet within the commercial market channel. There are three common categories; i) short-term rental / rent-a-car; all registrations made by rental car companies; ii) OEMs / dealers / manufacturers – demonstrators, loan cars, one-day registration, 0km, registrations made by manufacturers against themselves; iii) true fleets – all except the above categories.